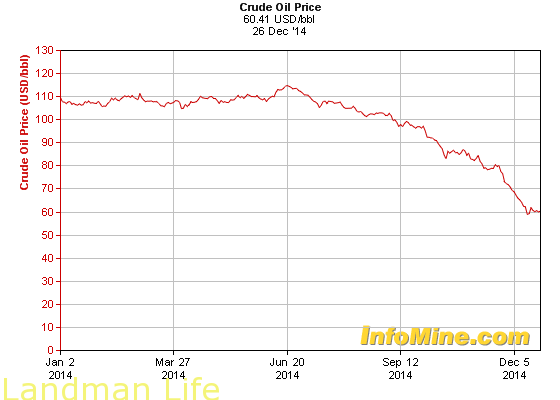

This seems like a great time to review the landman business in 2014 since the year is coming to an end. People talk about the “ups and downs” of the oil business, but a lot of you are too young to really know what the bottom is like. If you still have a job right now, make sure to do everything in your power to keep it, because the bottom isn’t here yet. We started 2014 with oil prices hovering around $105 a barrel. As Brad Pitt’s character says in the movie Inglorious Bastards, “business is a booming.” I had spent the year working for a small company of about 9 people, 7 of them being landmen. The biggest benefit of working for such a small company was job security. Our broker had worked a deal with a small producer to have our company in essence function as their land department. We’ll call that small producer “Enerplay.” Anyways, Enerplay kept at least 5 of our landmen busy at all times, and we usually had 2 landmen working on small projects for other clients. I spent half of the year working on prospects for Enerplay and the other half working on a small project for another client, let’s call them O.N.E. which stands for Obviously Not Experienced.

The months I spent working for O.N.E. were stressful to say the least. That company was run by some geologists that had been consultants until they came across Mr. Bigbucks, who wanted to be an “oilman.” These geologist consultants decided that they had what it takes to fulfill Mr. Bigbucks’ dream and started their own small production company. Well that’s all fine and dandy, but once they started looking at the logistics of actually producing oil, the learning curve bitch slapped them pretty hard. To assist with all of the land work associated with running a small production company they hired our company. Great! Let’s get some land work done, right?! Not so fast. The guys at O.N.E. had their own ideas of how land work should be done. I cannot tell you how many times my boss and I had conversations that went like this…

Boss: I just got off the phone with O.N.E., they called to let me know that they have started drilling on the Patricks tract…

Me: The Patricks tract is not one of their drill sites, why are they drilling there?

Boss: Yes, I know that the Patricks tract is not a drill site. I asked the same question and was told “well we’re drilling there, so we just wanted to let you know!”

Me: Ohhhhkkkkaaayyyy, since we don’t have a runsheet….or a title opinion…I’m guessing you need that done…yesterday?

Boss: That’s the gist of it. I told the guys that this isn’t how land work is done, and they told me that if we took a lease on the Patricks tract then obviously we gave them the go ahead to drill there. I then told them that taking a lease does not mean you can drill without a runsheet and title opinion unless you want to get sued.

Me: They probably didn’t understand what you said. How long do I have to get the Patricks runsheet done?

Boss: Well considering their last well took over 5 weeks to get drilled, I’d like for you to get that runsheet done in about 2 weeks and to the attorney so he can hopefully crank out a title opinion…

Me: Alright, gotta go, I’m getting to work.

The “fly by the seat of our pants” attitude of O.N.E. wasn’t even the most infuriating thing about working for them. Those consultants didn’t seem to comprehend that I, the landman, did not get paid ANY money until my broker got paid. Those fuckers routinely fell about 3 months behind on payment, so I routinely told my boss that I was not getting on the road until I got paid. It’s not like I run a charity here. On the bright side, I wasn’t having to stay in a town of 1,600 people, but was in an actual city at a nice hotel. Ironically the week before I finished working on their project, the hotel completed the construction on their bar in the lobby. Sure would have been nice if they’d gotten it done while I was still working out there, but that’s life. Another benefit of working for O.N.E. was their 90 day pay schedule meant that I would often receive multiple checks at once. Getting over $20,000.000 in the mail might seem like something to be excited about until you realize that you’ve already spent almost all of it on expenses. The area that these guys chose to spend Mr. Bigbuck’s money was an interesting decision, and I recall talking on the phone to a landman buddy at one point about our project. He pulled up the area on the Railroad Commission webpage to take a look at where I was working, and his response was, “What the hell are you guys drilling for? Dinosaur bones?” I was the only landman that anyone had seen in that county since about 2003. I remember when seeing $3.00 for a gallon of gas meant I would stop and top off my tank. When I finished up everything the idiots at O.N.E. needed, I got put back on an Enerplay project and was glad to have some consistency at least.

Working for Enerplay was more stable, they had a steady pay schedule and I was well briefed in the way they wanted things done. It was seldom to be surprised about anything they did, except the areas they chose to drill…they were always after old gas production. When you’d look at your prospect on the railroad commission it would invariable look like a pincushion there would be so many dots on the map. Aside from that it was a pretty normal job. We usually worked on our own, one landman for each prospect, unless things got really hairy and assistance was required. Over a couple of years I only worked with another landman on two prospects. Every few months we would have a “company meeting” to discuss everyone’s prospects and if you’ve read much of the content here you’ll probably know that nothing ever got accomplished when a bunch of landmen get together after the drinking and golfing started. We’d meet in the conference room of the hotel and our broker with the assistance of our “crew chief” would go through and call landmen up one by one to have them “present” their problem, and how it was ultimately solved. This experience was a great way for us to learn from each other, and after we got finished with our mini conference we’d head out to the golf course. Since most of us never worked with each other, or were even in the same county as one another, it was also a great time to socialize. The golf was always fun and the drinking usually went late into the night.

Then the price of oil started going down…

Everyone started to get worried, but we were assured “all is well.” Then Enerplay went all in on a huge prospect that surprised all of us. It wasn’t their style to go big like that. They were betting that the payoff would be commensurate with the up front expense. A few dry holes later, with income dwindling from older production, Enerplay cut exploration. Everyone is familiar with the “wait for January” line, which is what we got anytime a question was asked. Two weeks before Thanksgiving I got assigned to a curative project, which we were assured could “keep us busy for awhile.” A week later I got the call that I had been dreading. Enerplay was having more trouble than they let on, and our meager company was going to have to downsize as a result. The other small clients we had previously were not in need of any land work, so from 7 landmen the company became 2 landmen. The price of oil continued to fall. I scrambled to find work, knowing that the time between Thanksgiving and New Years is a very hard time to get hired, especially considering the lowering price of oil. All of the landmen I have worked with were either also looking for work, or barely holding on to what they had. My network has grown to be quite extensive over the years, but hope was hard to find. Of all the landmen I talked to, one who’s client was EOG would be the only person who I can say was “generally not too overly concerned at that time.” It was the same situation with all of the previous brokers I had worked with…except one. He was still booming.

Years and years ago, when I was but a wee-landman, I worked for a broker’s company that I eventually left. I left this company on good terms, or so I thought, but a year later when I was looking for work again, that broker made it abundantly clear that he took it very personally when I quit his company. His exact words were, “I’ll go through an entire stack of resumes before I ever hire you again.” Ouch. He was really offended about the whole deal. The reason I left was because I didn’t recognize what a solid relationship he had with the client. When it comes down to it, that really is the only thing that matters. Naive as I was, the grass was always greener on the other side. I moved on and didn’t think of him until a few years later I was out of work again. The company I jumped ship for ran out of work. We had violated the first rule of being a landman, DON’T WORK YOURSELF OUT OF A JOB. Once we finished all the work, they had no reason to keep us around. The broker gave me the same response, and again I moved on and found work elsewhere. This broker’s company grew steadily over the years, and by the time I lost my job right before Thanksgiving, he had over 100 people working for him. Landmen are a dime a dozen, but good landmen are much harder to find. A lot of those people working for him were warm bodies, but those warm bodies generated a good amount of money too. Maybe he had finally gotten to the bottom of that stack of resumes?

I sent him an email telling him how much I had matured since I last worked for him. I apologized for the manner in which I left his company and assured him that I would not “jump ship” again. To my surprise I got a phone call from the broker a few minutes later. He would rehire me, despite the fact that he was actively firing people due to the price of oil. I could start on December 1st. This was a huge relief, because as everyone knows…the price of oil kept going lower. I started working for this old broker, and to my surprise a lot of people I knew were still there…and still working in the same capacity as regular landmen. It was good to see some familiar faces and we all got caught up quickly. They asked what I had done over the years, and I would in return ask them what they had been up to. I had traveled all over the State of Texas, worked for a half dozen different companies and accumulated a list of experience in so many different areas of land work that it doesn’t fit on my resume. They had been working in the same county, in the same office, with the same people, in the same courthouse, for years. Stability is great but wouldn’t that get…boring? My appearance on the “crew list” was a relief to a lot of other landmen on our crew, because they figured that despite lowering oil prices the company was still growing. False. The first week I was on the job, 20 landmen got fired. The second week I was on the job, 15 landmen got canned. I was a little surprised to have gotten above the water line on the totem pole so quickly, but like I said…I’ve got experience. My third week nobody got laid off, and I was taking Friday off to be in a friends’ wedding.

After the wedding service was over, I checked my phone and saw a missed call from the broker. Never a good sign. Stupidly, I called him back before we were all supposed to line up for our pictures. He was cutting his company down to a third of its previous size, and as a result he would only be able to let me work part time. To be honest I’m not sure how to work as a part time landman, because you really need to be in the courthouse with the documents to do a runsheet, but part time was better than nothing. I apologized to my friend and his beautiful wife, because I have a dreadful feeling that I ruined the pictures I was in. It’s hard to force a smile right after news like that. A few days ago I got another call from the broker, he was scaling down again and had no more work for me. Both of my bosses got cut, including some people that had been with the same company for over 7 years. It was referred to as a “blood letting” by one of them. It’s sad to see how hard and sudden the lowering price of oil struck all of those landmen, and we haven’t even hit the bottom yet. Most market “analysts” predict that $40 something a barrel will be the norm for most of 2015, and that’s assuming that their predictions are right about the price forming a “floor” at $40. When I did the math a few weeks ago, an hour of my time (using a standard 8 hour workday) was worth just a couple dollars less than a barrel of oil. Obviously the economics of that situation are not sustainable. I don’t bother stopping to get gas unless it’s under $2.00 a gallon now.

What it all means. Throughout the entire process I knew what was happening, and why. Understanding the market right now is fairly simple for anyone that’s done some reading or watched the news over the past couple of months. Let’s dig into why the price of oil plummeted so much and talk about how it will eventually go back up. Over the last few years the biggest change in the oil market was rising American production from our “shale revolution.” If you’d like to read a book about the men that pioneered that revolution, I would highly recommend The Frackers by Gregory Zuckerman. This increase was bound to affect the market at some point because we began consuming less foreign oil, and all the hippy tree huggers in their Toyota Priuses and ugly solar panels on their roofs consumed less oil regardless of its source. The general premise for making money in the shale boom was to continually be drilling more wells, because the production curve falls off sharply after the first couple of months from a horizontal well drilled into shale, and then it either requires additional expenditure to be “reworked” or fracked again, or you accept the loss of production and have new wells drilled to compensate for it. That cycle required lots of capital (money), lots of personnel, and lots of rigs. The number of rigs operating in the United States is dropping and will most likely not rise again until late 2015 (Fuel Fix). Global factors have contributed to the drastic lowering of oil prices in the past few months as well.

Russia’s economy is tanking right now. It’s worse than ever during Putin’s time as President. Apparently riding horses (or bears…that’s a joke) shirtless and wrestling polar bears doesn’t do much to prop up your economy, so they are selling as much oil and gas as possible. Sanctions against Russia due to their actions in Ukraine appear to have some effect on this, but opinions vary to what degree. China’s economic growth has finally slowed, and therefore they are not requiring any more oil than they did in past years. The law of supply and demand comes into effect here, no increase in demand but an increase in supply produces a lower price. Even consumption in the United States has decreased slightly year over year, due to more people being “environmentally conscious” and increased fuel efficiency in cars and trucks. OPEC has decided that they will not decrease production to prop the price of oil up, which is meant to “price out” a lot of the production we have achieved in the shale regions here in the United States. Their strategy will work, unfortunately, because we have the highest cost of production of any oil producing country in the world. Saudi Arabia has the lowest cost of production in the world. If we want to “race them to the bottom” we’ll lose, simply put. Previously, Saudi Arabia acted as the “swing producer” for the world oil market, adjusting their production to keep prices as high as possible. Each oil company producing oil in the United States is now in the role of being a swing producer. They are each competing on a global stage with a cartel that has dictated oil prices for the last three decades. Landmen are going to get fucked in this deal.

Some people say that OPEC couldn’t lower production enough to prop up the price because of the increased production from the United States and Russia. In fact, there is talk that we are entering a new “era” of the oil market where OPEC no longer has influence over the price per barrel, but the market as a whole will dictate the price (Bloomberg). A couple of weeks ago I saw an interesting article that had “break even prices” for all of the different oil producing regions in the United States. The prices are just a compiled list of “projected” break even prices set by financial firms, but it is interesting nonetheless (Reuters). Here’s a similar article from Bloomberg that contains similar information but in a hard to read graph. So most people say that the price of oil going down means savings at the gas pump and therefore it will be a huge boon to our economic growth. That’s true, economically it will trigger growth like we haven’t seen since the recession. It will also trigger layoffs of thousands of workers in the oil fields across our country. When the price of oil is predicted to “rebound” sometime in late 2015, it’s not because of increased demand catching up to the surplus. It’s because a lot of the producers in the United States are expected to slow production or go out of business. Remember the first item on the list of what’s required to make money out of the shale boom, capital? A lot of producers are over leveraged now because their assets on the books are worth less than the debt they took on to keep continuing production.

There will be a wave of consolidation of those companies, the weak ones will get swallowed up by the stronger ones. Obviously the majors will come through unscathed, but the smaller independent producers are going to have a rough year. The client I was working for most recently is a strong “takeover target” because of their financials right now. With lowering oil prices it will be harder and harder for companies to swallow the multi million dollar cost of drilling horizontal wells that need to be fracked. There are still a lot of companies that will manage to stay above water by pursuing “conventional” production, meaning mostly vertical wells in proven fields. They might not be raking in the profits of past years, but they’ll be able to stay in business at least. If you’re working for one of those companies, do everything in your power to keep that job. What is going to happen to all of the landmen that will get laid off, or have already been laid off? I’m suspecting that there will be a good amount of them headed into real estate, title companies, and general sales jobs. I’ve talked to lots of my friends over the past week and I asked each of them what their backup plan was. One of them said he has a friend that owns a 711 convenience store he could work at, another said he would get back into the construction business, one said he could go work for his uncle’s insurance company, and a fourth said he would do “whatever…maybe deliver pizzas or be an Uber driver…” Most landmen don’t have many qualifications for employment in any other field which means they’ll be starting back at the bottom. It’s going to be a rough year for landmen, and many of them will end up going the way of the dinosaurs, joining them in extinction and unemployment.

This was originally posted to LandmanLife.com on December 30, 2014.